Your Guide to FHA 203(h)

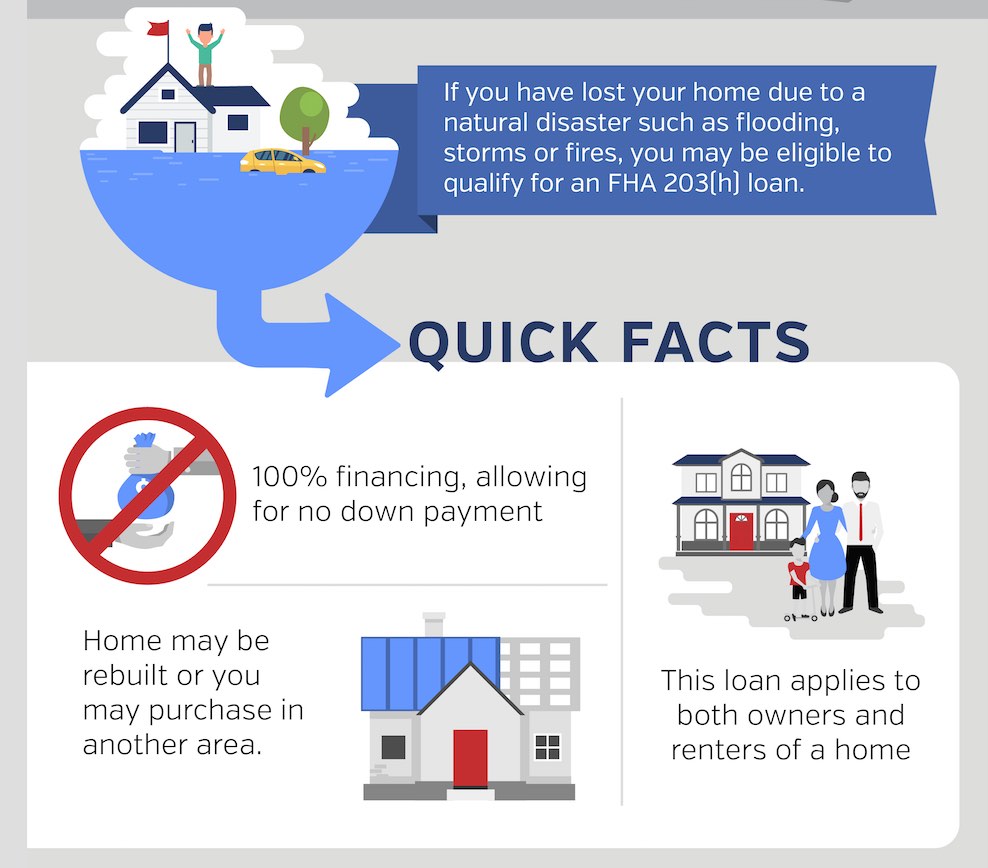

Did you know that there is a home loan specific for those recovering from a natural disaster? The FHA 203(h) loan is a great option for those who have become a displaced owner or renter due to a recent disaster such as flooding, storms or fires.  FHA 203(h) loans are applicable to qualified buyers who are either owners or renters of a property as long as it is their primary residence. One of the major advantages of this program is that it allows for 100% financing—making a down payment not required.

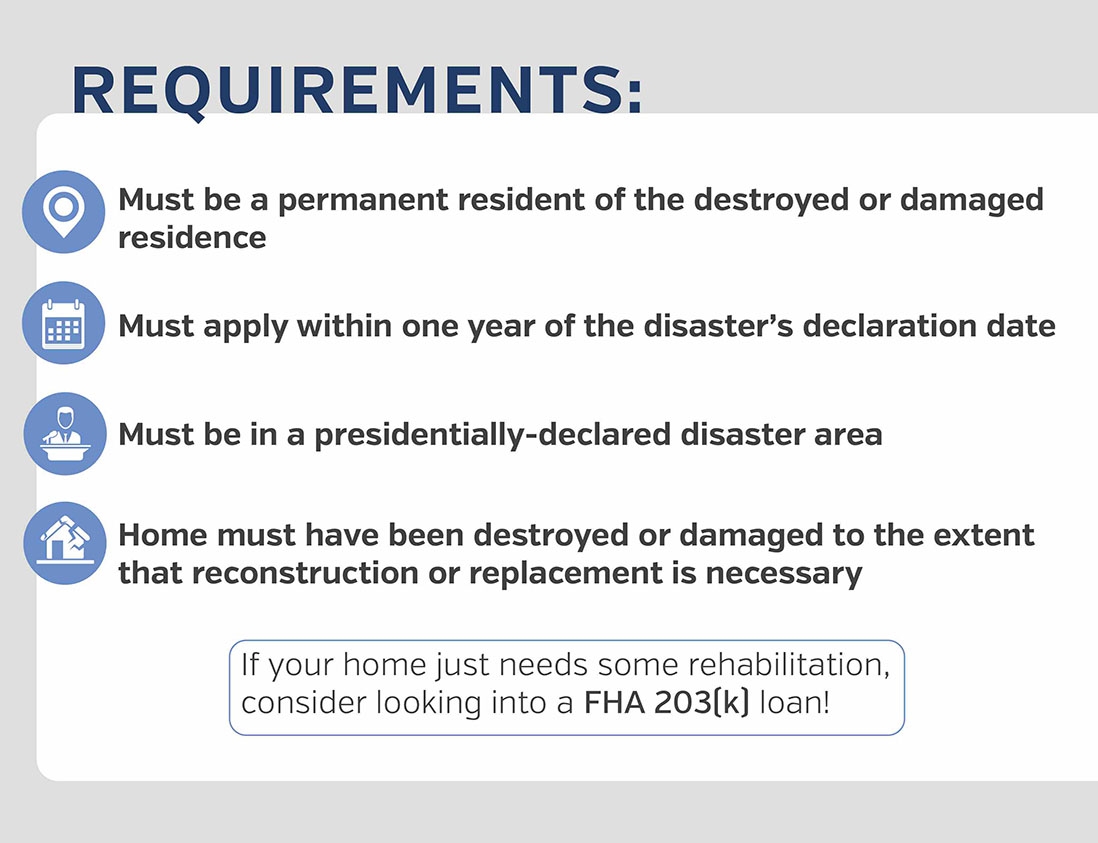

FHA 203(h) loans are applicable to qualified buyers who are either owners or renters of a property as long as it is their primary residence. One of the major advantages of this program is that it allows for 100% financing—making a down payment not required.  The FHA 203(h) program is designed for those whose property falls under a presidentially-declared disaster area, and who have either lost their homes or have had extensive damage. These mortgages may be used for a new purchase or the reconstruction of the home as long as they apply within one year of the major disaster declaration.

The FHA 203(h) program is designed for those whose property falls under a presidentially-declared disaster area, and who have either lost their homes or have had extensive damage. These mortgages may be used for a new purchase or the reconstruction of the home as long as they apply within one year of the major disaster declaration.

Note: In order to qualify for an FHA 203(h) the home must be destroyed or damaged to the extent that a reconstruction or replacement is necessary. If your home needs rehabilitation, you may consider looking into an FHA 203(k) option instead.

Have you or anyone you know has suffered extensive damage to their home due to a recent disaster? Learn more about the FHA 203(h) program!

Contact a Loan Officer today!